In a survival situation, the best form of wealth to hold would depend on the expected duration of the crisis.

Here’s how I think each option might fare in a few scenarios.

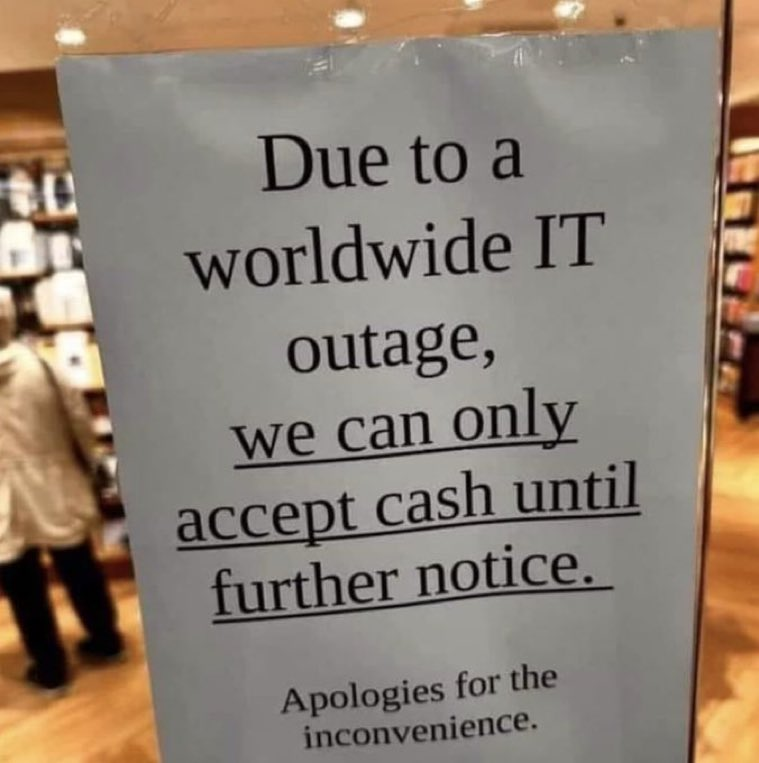

| Key takeways: • For short-term internet or electric grid outages, keep some cash on hand • For the long-term, store plenty of essential items for barter, a little bit of crypto, and some gold and silver |

Fiat Currency: In the initial stages of a crisis, fiat currency might retain its value and be useful for purchasing supplies. However, in a prolonged crisis, especially if it leads to hyperinflation or if the financial system collapses, fiat currency could lose its value rapidly.

Between 1935 and 1949, Shanghai experienced hyperinflation where prices increased a thousand fold. My father would receive his allowance by the duffle bag, and by the time he went to spend it, it was worth far less. In the end stages of the crisis it was said that homes were traded for ounces of gold coins.

Gold and Silver: Precious metals like gold and silver have been valued for millennia and can serve as a hedge against inflation and currency devaluation. They are universally recognized and can be bartered in most situations. However, their practicality depends on the ability to trade small, divisible amounts, and they may not be as useful for immediate, small-scale transactions. It’s therefore prudent to keep a variety of small denominations, such as 1/10 ounce gold coins and silver quarters. 1964 and earlier quarters are 90% silver.

That being said, having plenty of gold and silver will be difficult to transport without becoming a target.

Bitcoin: Bitcoin and other cryptocurrencies can be excellent for wealth preservation and may increase in value relative to fiat currencies in early stages of a financial crisis. However, their usefulness is contingent upon working digital infrastructure. In a scenario where electricity or internet access is unreliable, digital currencies may not be practical as they rely on functioning networks of computers to maintain the decentralization and security of their protocols.

However, unlike silver and gold, crypto are easily transported as all that is required is secure storage of your private keys. Private keys come in the form of a long string of characters or a seed phrase of 12 to 24 everyday words in a specific order. These can be stored digitally or written down on paper. Just be careful, as if anyone finds them, they can recover your wallet and drain it without your knowledge.

Barter Items: In a true survival situation, practical barter items can be the most valuable. Goods such as food, coffee, water, alcohol, medicine, fuel, and ammunition are universally needed and can be traded for other essential items. The value of barter items is immediate and tangible, but their usefulness is highly situational, and storing them in large quantities can be logistically challenging.

Ultimately, a diversified approach is best. Holding a mix of assets allows you to be prepared for a variety of scenarios. For instance, having a reserve of fiat currency for initial stages, precious metals for long-term value preservation and trading, a manageable amount of cryptocurrency for potential appreciation or digital transactions, and practical barter items can provide a well-rounded strategy for surviving and thriving in various emergency scenarios.